The government has unveiled its latest tax proposal to reduce taxation in connection with working, cars and pensions by a total of 23 billion kroner.

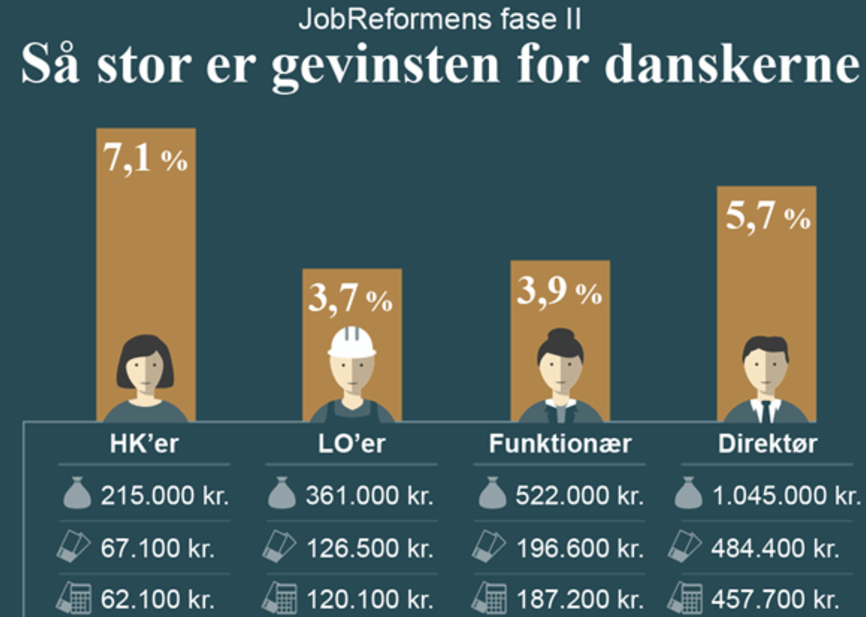

The proposal, ‘Jobreformens fase II’ (‘Job Reform Phase II’), hopes to push more Danes away from the doldrums of public support and into the realm of self-sustainability.

“We want to promote a society in which it is easier for people to support their own before they’re required to give a large chunk of their income to finance the costs of society,” wrote the government.

“A society in which normal and hardworking Danes have more economic relief on a daily basis and are able to keep a bit more for themselves when they earn more. A high marginal tax is detrimental to growth and employment.”

READ MORE: Danish government announces reform of benefits: It should pay to work

Work incentivisation

According to the government, the tax proposal (here in Danish) will lead to about 21,000 Danes getting more out of working.

Among the points of the proposal, the government wants to lower the car registration tax so that no-one will pay more than 100 percent in car registration tax.

The government also wants to remove the ceiling of the employment deduction (beskæftigelsesfradrag), which is currently at 30,000 kroner – this will benefit everyone with an annual salary of over 340,000 kroner.

The government also wants to make a new job deduction of 4,500 kroner earmarked for the lowest work incomes, as well as a social free card that allows vulnerable citizens to earn an extra amount tax free.