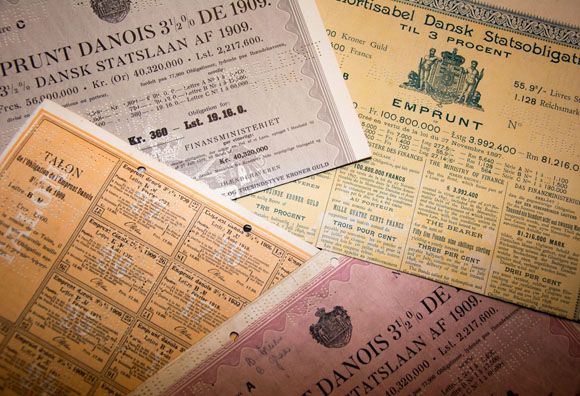

When Denmark pays off the last instalment of a loan of 1.5 billion US dollars today, it will be the first time since 1834 that the nation has had no foreign currency debt.

According to the finance minister, Kristian Jensen, the historic event shows the great trust Denmark has established abroad in terms of the nation’s economy and fixed exchange rate policy. But Denmark shouldn’t rest on its laurels.

“The debt settlement shouldn’t be seen as a reason for slacking off,” said Jensen.

“From 2030 we have an outlook that indicates 20 years of a huge public deficit because the baby boomers will leave the labour market and be replaced by smaller generations. If we don’t meet this challenge, we risk devastating gaps in the international trust in Denmark’s economy.”

READ MORE: Danes owe the state over 90 billion kroner on unpaid tax and fines

Domestic debt remains

Denmark’s first state loan in foreign currency was taken in 1757, when the state loaned the equivalent of a half million rigsdaler from Hamburg and Amsterdam. The records are incomplete for the period leading up to 1834, so it is possible that the state also had foreign currency debt between 1757 and 1834.

Loans in foreign currencies are used to ensure adequate foreign reserves, which are in turn used to maintain the Danish fixed exchange rate policy. But with the foreign reserve as it is now, it has not been necessary to take out loans in foreign currency and the debt has now been completely settled.

The state still has domestic debt in Danish kroner to the tune of approximately 650 billion kroner – about 32 percent of GDP. Foreign investors own about 40 percent of the domestic debt.